Bitcoin Whale Activity Peaks Amid Market Uncertainty

According to Glassnode, Bitcoin whales—entities holding over 10,000 BTC—achieved an accumulation score of approximately 1.0 earlier this month, reflecting intense buying activity.

This score marks a significant deviation from the behavior of smaller holders, who are leaning toward distribution.

Why Bitcoin Whales Are Buying While Smaller Holders Sell

Glassnode highlighted the shift in the latest X (formerly Twitter) post.

“Whales holding >10,000 BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month,” Glassnote posted.

This score reflected a 15-day period of intense purchasing activity. However, after this spike, the score slightly eased to around 0.65. While this suggested a more moderate pace of buying, it still pointed to steady accumulation by large holders.

Meanwhile, smaller Bitcoin holders, categorized as those with holdings between <1 BTC and 100 BTC, shifted their focus to distribution. On-chain data revealed that these cohorts have significantly increased their selling activity, with accumulation scores trending down to between 0.1 and 0.2.

“This divergence shows the bigger players are still accumulating, while smaller holders are selling. Market sentiment remains split,” a user noted on X.

The growing gap between the actions of large and small holders is indicative of differing market sentiments. Whales appear to be betting on Bitcoin’s long-term growth. At the same time, smaller holders may be more cautious or reactive, choosing to liquidate their positions as a hedge against potential market downturns.

The contrasting strategies come amid heightened geopolitical tensions and trade war concerns, which some analysts believe will drive Bitcoin’s appeal as a hedge. Industry expert Will Clemente recently weighed in on the broader implications.

“Zooming out, seeds are being sown for global accumulation of BTC for not only hedging against money supply but de-globalization and geopolitical tensions. These allocations won’t come overnight, but this is what Bitcoin was made for,” Clemente remarked.

Despite the long-term optimism, the macroeconomic conditions have weighed heavily on BTC, causing it to drop below $80,000. Nonetheless, BeInCrypto data showed that Bitcoin saw modest gains of 5.0% over the past day. At the time of writing, it traded at $79,454.

Notably, the price dip has led to significant unrealized losses for public companies holding Bitcoin reserves, with many now seeing their holdings valued below their acquisition costs. In fact, Strategy even paused its Bitcoin purchases, reflecting caution in the face of market uncertainty.

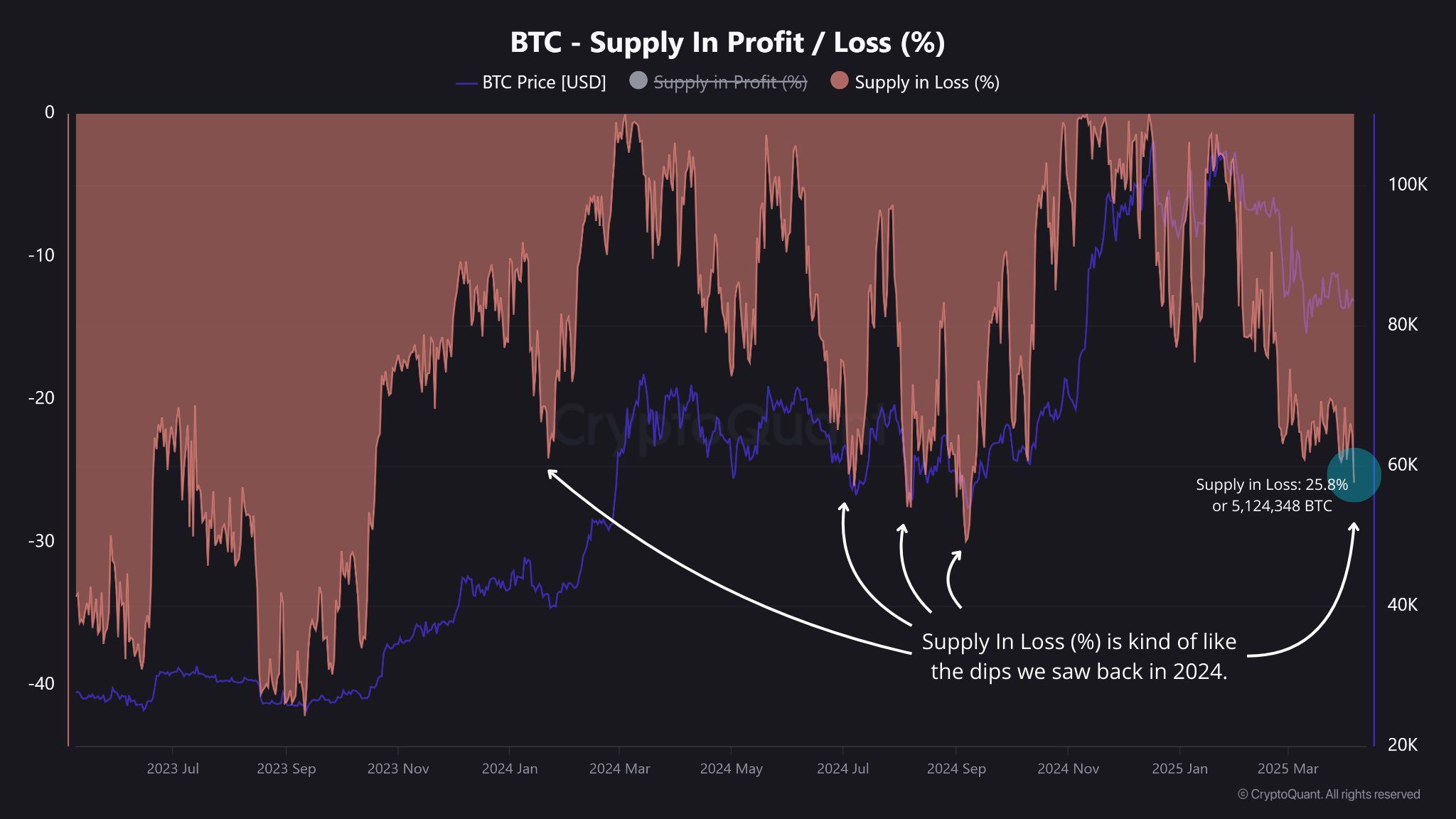

Moreover, data from CryptoQuant disclosed that 25.8% of the total Bitcoin supply is in loss.

“While it might seem alarming, it’s not unprecedented,” the post noted.

CryptoQuant added that similar scenarios have occurred throughout 2024, where a substantial portion of Bitcoin was also held at a loss. For instance, in January 2024, 24.1% of the circulating Bitcoin was underwater. In September, that figure rose to 29.9%.

Thus, these fluctuations show that periods of Bitcoin being held at a loss are not unusual and are part of the market’s cyclical nature, where price corrections affect a significant share of the supply.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.