HBAR Price Faces Fresh Selling After Two-Month Calm

The HBAR price has struggled to find direction this week. After slipping 4.3% over the past seven days, it now trades near $0.21 — a modest move considering the network’s earlier momentum. On the monthly chart, HBAR is down 7.5%, and its once-strong three-month trend has cooled to just 8.5% gains.

Data now points to fading optimism, with sellers resurfacing after almost two months of buyer dominance. The setup suggests that while a full rally may be off the table for now, a recovery phase could still emerge if key signals stabilize.

Sponsored

Sponsored

Sellers Return After Weeks of Calm as Large Money Weakens

The latest exchange flow data shows a decisive shift. After eight straight weeks of negative net inflows — meaning coins were leaving exchanges — HBAR’s weekly flows have flipped positive for the first time since late July.

That indicates that more tokens are now moving onto exchanges, typically a sign that holders are preparing to sell.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

To put it in perspective, last week’s data showed –10 million HBAR in outflows. This week, that has reversed to +511,000 HBAR in inflows — an almost 100% complete reduction in buying pressure, marking a clear change in sentiment.

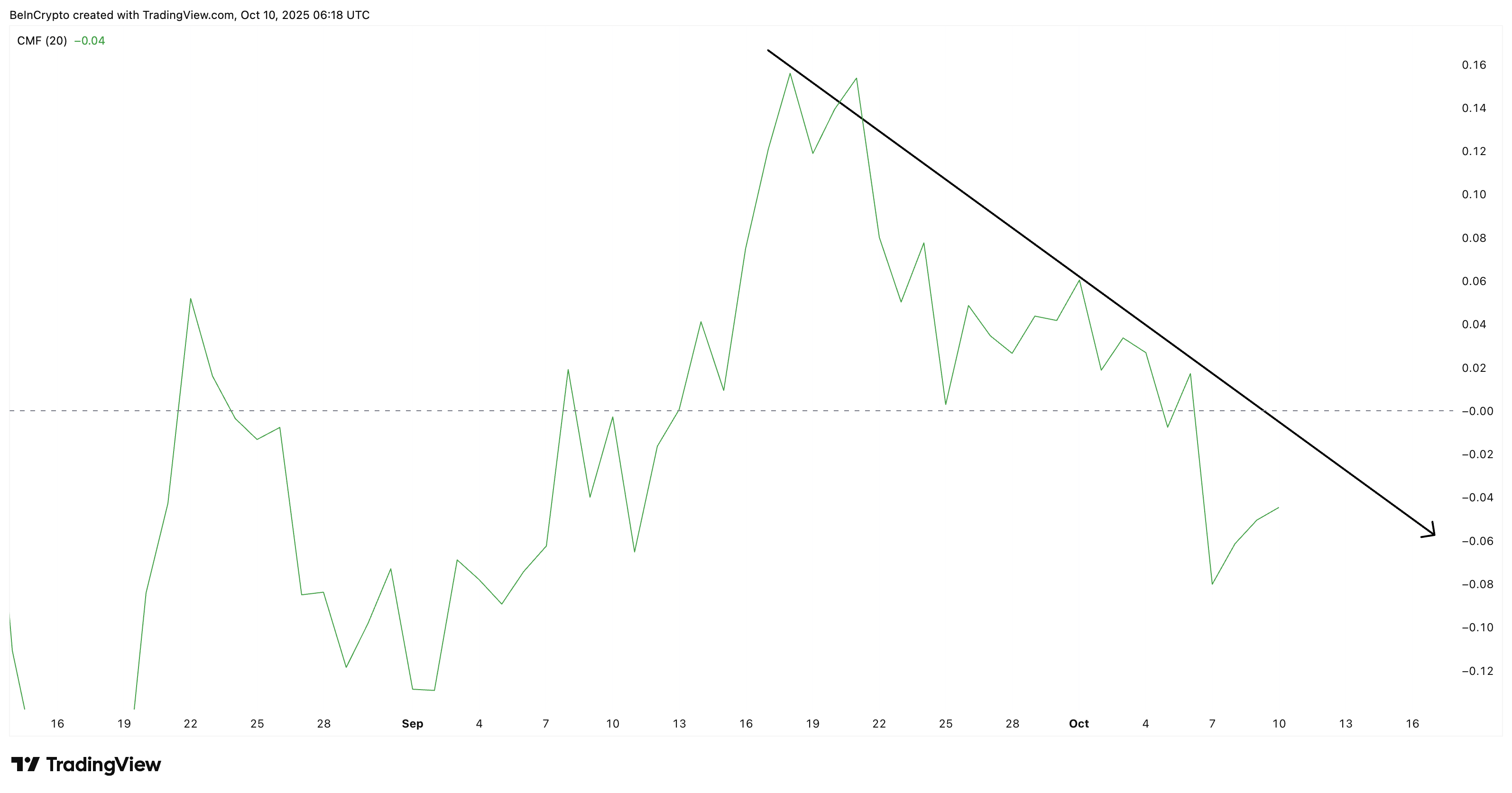

This reversal aligns with weakness in the Chaikin Money Flow (CMF), a metric that measures large or institutional money by combining price and volume. Since September 18, CMF has been forming lower highs, showing that big players have been gradually stepping back.

It dipped below zero on October 6, confirming that selling pressure has overtaken buying strength, even across big wallets.

Sponsored

Sponsored

While the CMF remains negative, it has started to curl upward slightly, hinting that some accumulation might be returning near the current support.

If CMF turns positive by the week’s end, it could signal that buyers are stepping back in and help HBAR avoid a sharper correction.

Smart Money Suggests a Modest HBAR Price Recovery, Not a Rally

Despite weakness in large capital flows, the Smart Money Index (SMI)— which tracks the positioning of sophisticated short-term traders and early movers — offers a glimmer of hope for the HBAR price. The index has been forming higher lows since September 25, suggesting that small but active players are gradually rebuilding exposure, even as the broader market sentiment continues to be cautious.

This could support a short-term recovery toward $0.22–$0.23, especially if buying activity picks up before the week ends. However, a close below $0.20 would erase that possibility and could send the HBAR price lower.

For now, the market’s tone is defensive. Institutional money is cautious, sellers are back, and buyers are selective. A full-scale HBAR price rally may be off the table.

But as smart money edges in and if CMF stabilizes, followed by exchange netflows turning negative by the weekend, HBAR could still trade rally hopes for a limited recovery — provided sellers don’t regain sizeable control by the week’s close.