Is a Crash Coming? — $1.1B Bet Against Bitcoin

Recent data from the Bitcoin options market indicates a significant increase in trading volume betting on a price decline over the past 24 hours.

Greeks.live, a crypto options analytics firm, noted a significant trend. A post on X on Thursday showed that more than $1.15 billion has poured into out-of-the-money (OTM) put options.

Key Data Points to a Growing Bearish Sentiment

The firm explained that bearish bets have noticeably increased over the last 24 hours, with 28% of total options volume flowing into OTM put options. OTM put options are highly speculative positions that benefit from a substantial future drop in asset price.

Sponsored

Sponsored

The options contract’s implied volatility has turned more negative this week. It has reached levels similar to those seen on October 11, the day after a significant market crash.

Greeks.live noted that the cryptocurrency market has experienced extreme volatility since news of President Trump’s tariff war broke last Friday, causing a rapid swing between bullish and bearish sentiment. The firm believes the market’s focus is shifting toward a bearish outlook.

This trend in the options market suggests that large-scale liquidity providers and market makers are pricing in a considerable risk of a price drop. While Bitcoin’s technical trend remains intact, Greeks.live recommends buying put options as a suitable hedging tool in the current climate.

On-Chain Data Echoes Bearish Signs

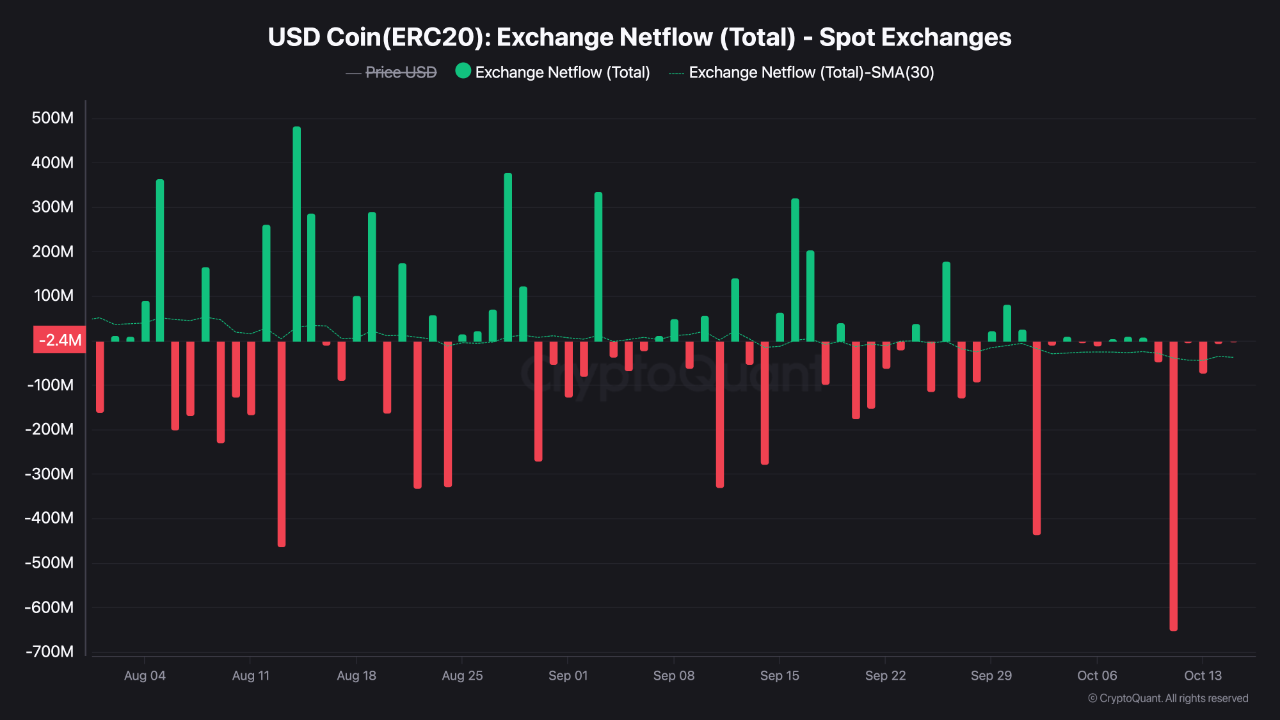

CryptoQuant analyst TeddyVision pointed to a similar sentiment in stablecoin flows. He views stablecoins as the “arteries” of crypto liquidity, with most flows heading toward Bitcoin. However, he warns against confusing spot and derivatives trading.

TeddyVision highlighted two distinct trends from August 1 to mid-October 2025. An analysis of the 30-day SMA of stablecoin net inflows to exchanges shows that capital used for actual asset purchases has decreased, while liquidity supporting leveraged derivatives like futures and perpetual contracts has increased.

“It shows that price growth is not being driven by organic demand but by speculative leverage and synthetic exposure—through derivatives and ETF—linked capital rotation. In short, the engine is still running, but it’s running on fumes.”