‘Long Live the King’: Bitcoin Billionaire Arthur Hayes Predicts the BTC 4-Year Cycle Is Over

In brief

- Bitcoin bull Arthur Hayes thinks BTC’s traditional four-year cycle is over.

- The entrepreneur says increased money supply will benefit the asset.

- Hayes, however, has previously labeled his bullish predictions as “pretty shit.”

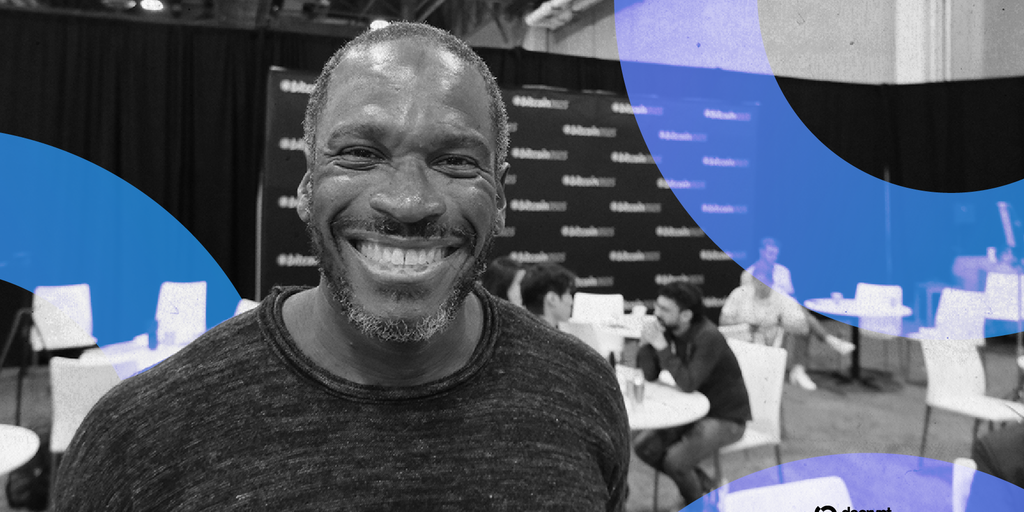

Crypto entrepreneur Arthur Hayes continues to say that an increased money supply will benefit Bitcoin—and now believes that the leading cryptocurrency’s traditional four-year cycle is over.

In a Thursday blog post named “Long Live the King,” Hayes wrote that while some crypto traders are expecting Bitcoin to reach its cycle top soon and crash next year, he believes that things will be different this time around.

Bitcoin’s typical cycle sees the coin hit a high the year after its halving, only to plunge by 70-80% the following year. Experts this year have disagreed about how the coin will behave after it hit an all-time high in 2024, ahead of its halving, bucking the previous trend.

“As the four-year anniversary of this fourth cycle is upon us, traders wish to apply the historical pattern and forecast an end to this bull run,” wrote former BitMEX boss Hayes.

“They apply this rule without understanding why it worked in the past,” he added. “And without this historical understanding, they miss why it will fail this time.”

Hayes, who received a pardon from U.S. President Donald Trump this year after failing to operate an anti-money laundering program at his crypto exchange, argued that the Fed cutting interest rates and China not wanting to hinder “global fiat credit growth” will benefit digital assets.

Lower interest rates means more cash flowing around the economy. Bitcoin and other cryptocurrencies have typically performed well—along with stocks—in a low-interest rate environment.

President Trump has piled pressure onto Federal Reserve Chair Jerome Powell to cut interest rates—and quickly—which he did in September for the first time in 2025.

“In the U.S., newly elected President Trump wants to run the economy hot. He routinely speaks about America growing in order to reduce its debt load,” wrote Hayes. “He lambasts the Fed for a too-tight monetary supply. His desire is generating action. The Fed resumed cutting interest rates in September even though inflation is above its own target.”

“Listen to our monetary masters in Washington and Beijing,” Hayes continued. “They clearly state that money shall be cheaper and more plentiful. Therefore, Bitcoin continues to rise in anticipation of this highly probable future.”

Experts have been torn on what Bitcoin will do this time around. Some analysts—including blockchain data firm CoinGlass—have argued that the top price for the coin looks like it is in, and that Bitcoin is behaving now like it did in previous cycles.

But the approval of spot Bitcoin ETFs last year may have thrown a wrench into the traditional cycle, generating new highs both before and after the last halving, experts told Decrypt. An increased money supply will ultimately benefit “risk-on” assets like Bitcoin, others said.

Gabe Selby, head of research at CF Benchmarks, told Decrypt that the current cycle remains undervalued by 20–50% relative to liquidity conditions.

“Despite near-term volatility tied to Fed policy recalibration and dollar weakness, our model suggests a sustained reflationary impulse will persist as monetary easing broadens across advanced economies in 2026,” he said.

Meanwhile, Kaiko Senior Research Analyst Adam McCarthy told Decrypt: “Crypto is 16 years old. You can’t figure out a pattern for an asset that young.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.